Dreaming of your ideal home but facing typical mortgage hurdles? A private mortgage loan could be the key you've been searching for. These loans, frequently offered by independent lenders, provide tailored financing options that can fit your specific circumstances better than conventional lending routes. With a private mortgage loan, you can possibly acquire funding for a wider range of properties and benefit from more flexible terms. Discover how a private mortgage loan can help you realize your here homeownership goals.

- Consider a private mortgage loan if you have unique financial needs.

- Investigate different lenders to discover the best match for your situation.

Finding Financing: Private Mortgage Lenders for Every Situation

Securing financing can be a daunting task, particularly when orthodox lending options fall short. That's where private mortgage lenders step in, offering creative solutions tailored to individual financial situations. Whether you're facing challenging credit history, require alternative loan structures, or simply need a quicker approval process, private lenders can provide the capital resources you need to achieve your homeownership goals. With their diverse networks and knowledge in non-traditional lending, they can help navigate the complexities of the mortgage market and unleash opportunities often overlooked by mainstream lenders.

Facing a Less-Than-Perfect Credit Score? Private Home Loans Offer Solutions

If your credit history hampers your dream of homeownership, don't despair. Specialized home loans can be a suitable solution. These loans are designed particularly for borrowers with less-than-ideal credit scores, providing an opportunity to secure financing and achieve your real estate goals. With attractive interest rates and adjustable terms, alternative home loans can make the path to homeownership more accessible for those facing credit challenges.

- Gain access to homeownership even with a less-than-perfect credit score

- Benefit competitive interest rates and flexible terms

- Discover financing options that cater specifically to your needs

Protect Your Future with a Private Home Loan

Are you dreaming of owning your own dream home? A private home loan could be the key to unlock your aspirations. Unlike traditional mortgages, private loans offer adaptability and personalized terms that cater your unique needs. With a private home loan, you can avoid the rigid criteria of traditional lenders and realize your homeownership targets sooner.

Take control of your monetary future and investigate the perks of a private home loan today. Our team of qualified experts is here to support you through the entire procedure and ensure a smooth and positive outcome.

Private Mortgage Lending: Flexible Options for Unique Needs

In today's dynamic real estate market, traditional mortgage lending doesn't always accommodate every individual's unique situation. This is where private mortgage lending enters the picture as a valuable option. Private lenders, often independent, offer tailored loan programs designed to resolve the requirements of borrowers who may not be eligible for conventional financing. These initiatives can be particularly beneficial for individuals with complex financial histories.

- Numerous private lenders specialize in lending to borrowers with self-employment income, .

- Private mortgage loans often offer faster approval times

- Due to their relaxed requirements, private lenders can provide funding opportunities that traditional lenders may not.

If you're facing obstacles in obtaining standard loans, exploring private mortgage lending could be a valuable next step.

Get Approved Today! Private Home Loans and Bad Credit.

Dealing with challenging credit? Don't give up hope on your dream of becoming a homeowner. Private home loans are available to assist, providing you with even with bad credit. Get in touch with our specialists is committed to finding the perfect loan for your unique circumstances.

Apply immediately and take the first step toward making your house a reality. We offer competitive rates and terms, making your mortgage journey as stress-free as can be as possible.

Rider Strong Then & Now!

Rider Strong Then & Now! Ross Bagley Then & Now!

Ross Bagley Then & Now! Michelle Trachtenberg Then & Now!

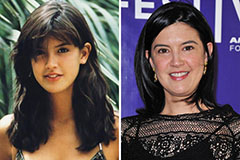

Michelle Trachtenberg Then & Now! Phoebe Cates Then & Now!

Phoebe Cates Then & Now! Dawn Wells Then & Now!

Dawn Wells Then & Now!